Nebraska Sales Use Tax . the nebraska state sales tax rate is 5.5%, and the average ne sales tax after local surtaxes is 6.8%. the nebraska state sales and use tax rate is 5.5% (.055). nebraska sales and use tax rates in 2024 range from 5.5% to 7.5% depending on location. currently, combined sales tax rates in nebraska range from 5% to 7%, depending on the location of the sale. Make sure to use the correct number. locate the nebraska id number and pin issued by the department of revenue. nebraska net taxable sales and use tax worksheets • the online version of these worksheets expands for detailed. Are there county as well as city sales and use taxes in nebraska?. what are the sales and use tax rates in nebraska? nebraska jurisdictions with local sales and use tax. , notification to permitholders of changes in local sales.

from www.formsbank.com

locate the nebraska id number and pin issued by the department of revenue. what are the sales and use tax rates in nebraska? Are there county as well as city sales and use taxes in nebraska?. nebraska sales and use tax rates in 2024 range from 5.5% to 7.5% depending on location. nebraska net taxable sales and use tax worksheets • the online version of these worksheets expands for detailed. Make sure to use the correct number. the nebraska state sales and use tax rate is 5.5% (.055). , notification to permitholders of changes in local sales. nebraska jurisdictions with local sales and use tax. currently, combined sales tax rates in nebraska range from 5% to 7%, depending on the location of the sale.

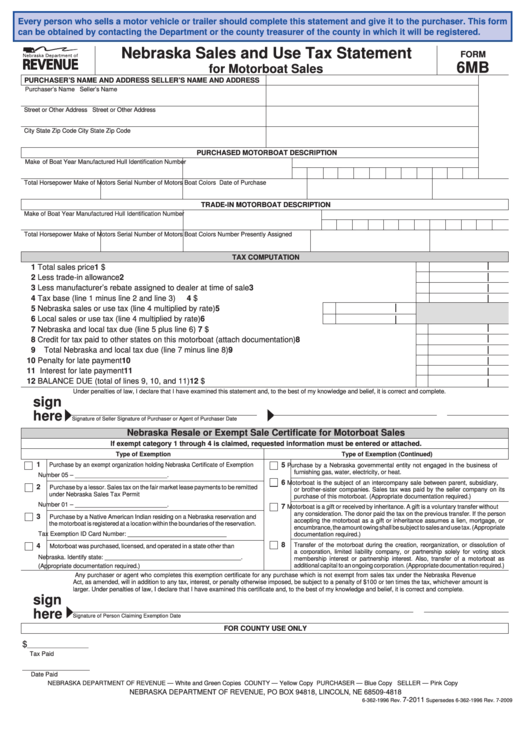

Form 6mb Nebraska Sales And Use Tax Statement printable pdf download

Nebraska Sales Use Tax what are the sales and use tax rates in nebraska? locate the nebraska id number and pin issued by the department of revenue. Are there county as well as city sales and use taxes in nebraska?. the nebraska state sales and use tax rate is 5.5% (.055). Make sure to use the correct number. the nebraska state sales tax rate is 5.5%, and the average ne sales tax after local surtaxes is 6.8%. currently, combined sales tax rates in nebraska range from 5% to 7%, depending on the location of the sale. what are the sales and use tax rates in nebraska? nebraska net taxable sales and use tax worksheets • the online version of these worksheets expands for detailed. nebraska sales and use tax rates in 2024 range from 5.5% to 7.5% depending on location. nebraska jurisdictions with local sales and use tax. , notification to permitholders of changes in local sales.

From www.formsbank.com

Fillable Form 6 Nebraska Sales/use Tax And Tire Fee Statement For Nebraska Sales Use Tax nebraska net taxable sales and use tax worksheets • the online version of these worksheets expands for detailed. nebraska sales and use tax rates in 2024 range from 5.5% to 7.5% depending on location. nebraska jurisdictions with local sales and use tax. locate the nebraska id number and pin issued by the department of revenue. Make. Nebraska Sales Use Tax.

From formspal.com

Nebraska Sales Tax Form ≡ Fill Out Printable PDF Forms Online Nebraska Sales Use Tax Make sure to use the correct number. nebraska net taxable sales and use tax worksheets • the online version of these worksheets expands for detailed. the nebraska state sales tax rate is 5.5%, and the average ne sales tax after local surtaxes is 6.8%. locate the nebraska id number and pin issued by the department of revenue.. Nebraska Sales Use Tax.

From www.dochub.com

DocHub 69585242Form6MBNebraskaGet the free Form 6MB Nebraska Nebraska Sales Use Tax nebraska jurisdictions with local sales and use tax. Are there county as well as city sales and use taxes in nebraska?. the nebraska state sales tax rate is 5.5%, and the average ne sales tax after local surtaxes is 6.8%. the nebraska state sales and use tax rate is 5.5% (.055). nebraska sales and use tax. Nebraska Sales Use Tax.

From platteinstitute.org

Nebraska’s Sales Tax Nebraska Sales Use Tax what are the sales and use tax rates in nebraska? , notification to permitholders of changes in local sales. the nebraska state sales and use tax rate is 5.5% (.055). nebraska net taxable sales and use tax worksheets • the online version of these worksheets expands for detailed. Make sure to use the correct number. currently,. Nebraska Sales Use Tax.

From www.templateroller.com

Form 6ATV Download Fillable PDF or Fill Online Nebraska Sales and Use Nebraska Sales Use Tax locate the nebraska id number and pin issued by the department of revenue. the nebraska state sales and use tax rate is 5.5% (.055). currently, combined sales tax rates in nebraska range from 5% to 7%, depending on the location of the sale. nebraska sales and use tax rates in 2024 range from 5.5% to 7.5%. Nebraska Sales Use Tax.

From howtostartanllc.com

Nebraska Sales Tax Small Business Guide TRUiC Nebraska Sales Use Tax , notification to permitholders of changes in local sales. currently, combined sales tax rates in nebraska range from 5% to 7%, depending on the location of the sale. the nebraska state sales tax rate is 5.5%, and the average ne sales tax after local surtaxes is 6.8%. what are the sales and use tax rates in nebraska?. Nebraska Sales Use Tax.

From printableformsfree.com

Nebraska Estimated Tax Form 2023 Printable Forms Free Online Nebraska Sales Use Tax currently, combined sales tax rates in nebraska range from 5% to 7%, depending on the location of the sale. nebraska jurisdictions with local sales and use tax. what are the sales and use tax rates in nebraska? , notification to permitholders of changes in local sales. nebraska sales and use tax rates in 2024 range from. Nebraska Sales Use Tax.

From www.formsbank.com

Form 6xn Amended Nebraska Sales/use Tax And Tire Fee Statement Nebraska Sales Use Tax nebraska net taxable sales and use tax worksheets • the online version of these worksheets expands for detailed. Make sure to use the correct number. Are there county as well as city sales and use taxes in nebraska?. nebraska jurisdictions with local sales and use tax. the nebraska state sales tax rate is 5.5%, and the average. Nebraska Sales Use Tax.

From www.formsbank.com

Nebraska Sales And Use Tax Guide For Veterinarians 2011 printable pdf Nebraska Sales Use Tax locate the nebraska id number and pin issued by the department of revenue. Are there county as well as city sales and use taxes in nebraska?. nebraska jurisdictions with local sales and use tax. the nebraska state sales tax rate is 5.5%, and the average ne sales tax after local surtaxes is 6.8%. nebraska net taxable. Nebraska Sales Use Tax.

From www.formsbank.com

Notice To Nebraska And Local Sales And Use Tax Permitholders printable Nebraska Sales Use Tax nebraska sales and use tax rates in 2024 range from 5.5% to 7.5% depending on location. the nebraska state sales tax rate is 5.5%, and the average ne sales tax after local surtaxes is 6.8%. locate the nebraska id number and pin issued by the department of revenue. Are there county as well as city sales and. Nebraska Sales Use Tax.

From www.templateroller.com

Form 10 Download Fillable PDF or Fill Online Nebraska Net Taxable Sales Nebraska Sales Use Tax , notification to permitholders of changes in local sales. Make sure to use the correct number. what are the sales and use tax rates in nebraska? locate the nebraska id number and pin issued by the department of revenue. nebraska net taxable sales and use tax worksheets • the online version of these worksheets expands for detailed.. Nebraska Sales Use Tax.

From www.signnow.com

Nebraska Sales and Use Tax Statement for Motorboat Sales 6MB Fill Out Nebraska Sales Use Tax the nebraska state sales and use tax rate is 5.5% (.055). nebraska sales and use tax rates in 2024 range from 5.5% to 7.5% depending on location. locate the nebraska id number and pin issued by the department of revenue. nebraska net taxable sales and use tax worksheets • the online version of these worksheets expands. Nebraska Sales Use Tax.

From webinarcare.com

How to Get Nebraska Sales Tax Permit A Comprehensive Guide Nebraska Sales Use Tax locate the nebraska id number and pin issued by the department of revenue. currently, combined sales tax rates in nebraska range from 5% to 7%, depending on the location of the sale. Make sure to use the correct number. Are there county as well as city sales and use taxes in nebraska?. what are the sales and. Nebraska Sales Use Tax.

From llcbible.com

Nebraska EIN number LLC Bible Nebraska Sales Use Tax what are the sales and use tax rates in nebraska? nebraska net taxable sales and use tax worksheets • the online version of these worksheets expands for detailed. , notification to permitholders of changes in local sales. currently, combined sales tax rates in nebraska range from 5% to 7%, depending on the location of the sale. Are. Nebraska Sales Use Tax.

From www.formsbank.com

Form 10 Nebraska And Local Sales And Use Tax Return printable pdf Nebraska Sales Use Tax currently, combined sales tax rates in nebraska range from 5% to 7%, depending on the location of the sale. the nebraska state sales tax rate is 5.5%, and the average ne sales tax after local surtaxes is 6.8%. locate the nebraska id number and pin issued by the department of revenue. Are there county as well as. Nebraska Sales Use Tax.

From www.formsbank.com

Form 10 Nebraska And Local Sales And Use Tax Return Example printable Nebraska Sales Use Tax nebraska net taxable sales and use tax worksheets • the online version of these worksheets expands for detailed. , notification to permitholders of changes in local sales. the nebraska state sales tax rate is 5.5%, and the average ne sales tax after local surtaxes is 6.8%. locate the nebraska id number and pin issued by the department. Nebraska Sales Use Tax.

From www.salestaxhelper.com

Nebraska Sales Tax Guide for Businesses Nebraska Sales Use Tax nebraska net taxable sales and use tax worksheets • the online version of these worksheets expands for detailed. Are there county as well as city sales and use taxes in nebraska?. nebraska jurisdictions with local sales and use tax. the nebraska state sales tax rate is 5.5%, and the average ne sales tax after local surtaxes is. Nebraska Sales Use Tax.

From www.taxuni.com

Nebraska Sales Tax 2023 2024 Nebraska Sales Use Tax the nebraska state sales tax rate is 5.5%, and the average ne sales tax after local surtaxes is 6.8%. Make sure to use the correct number. what are the sales and use tax rates in nebraska? nebraska sales and use tax rates in 2024 range from 5.5% to 7.5% depending on location. nebraska net taxable sales. Nebraska Sales Use Tax.